This indicator has been updated! See the new post here.

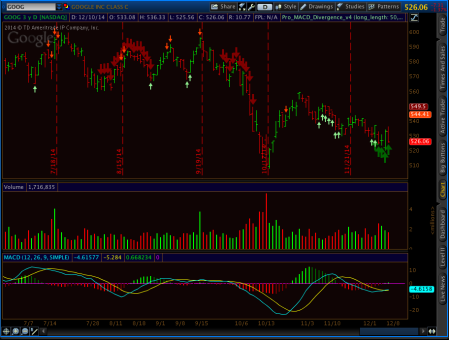

Following on the heels of my Swing Points indicator, I wrote an indicator that looks for divergences between the MACD and price. Every time we get a lower swing low, the MACD is checked to see if it also prints a lower low. Similar for highs; higher high without higher MACD is a divergence. Here are two pictures of the indicator at work. I have my Pro SwingPoints plotted in gray, and the ProMACDDivergence plotted as a red dot for bearish divergence, and a green dot for bullish divergence

First, a 5min chart of ES:

And next a daily chart of ES:

This is not really a strategy I am interested in personally, but many people use MACD as a part of their trading system. So, I won’t go into the theory of how to use it or sing its praises here. There are plenty of sites out there with that info. I’ll talk about the construction of the indicator so you can “try this at home”.

As I said before, you could define your swing points as follows:

Def swinghigh = if high > high[1] and high > high[2] and high > high[-1] and high > high[-2] then 1 else 0;

and

Def swinglow = if low < low[1] and low< low[2] and low < low[-1] and low < low[-2] then 1 else 0;

If you want x more bars to define the swing points, you add more high > high[x] and low < low[x] checks.

Next, you use the “reference” Thinkscript command to access the built-in code for the MACD indicator. To use reference, simply type “reference” and the name of the built-in study you want to access, followed by a “.” and the name of the output parameter you want to get. For this example, I wanted MACD and “value” as my output, so I used “reference MACD.value”. To find all of the possible output parameters and how to call them, add the built-in study to any to a chart, and then look at the names of all of the outputs:

You can also specify both inputs and outputs, such as “reference MACD(macdlength=5).diff”, which would change the period of the moving average of MACD from the default of 9 to 5, and return the histogram value. If you don’t include an input in a reference call, Thinkscript will just use the default value.

Meanwhile, back at the ranch, I wrote two recursive functions to check for and track the value of MACD at each swing point:

rec blMACD = if swinglow then reference MACD.value else blMACD[1];

rec brMACD = if swinghigh then reference MACD.value else brMACD[1];

This code will check if the current bar is a swing point according to your definition, and if so, it returns the value of the MACD there. If it is not a swing point, it just rolls the prior swing point MACD value forward. I also wrote similar functions to track the prior value for swing lows and swing highs using the same type of logic. The final task is to check at each swing low to see if it is lower than the previous swing low, but has a higher value of MACD for bullish divergence, and vice versa for bearish divergence, i.e. higher swing high, lower MACD value. If the check for divergence is true, I plot the respective low/high of the swing point bar, colored red for bearish and green for bullish.

This should be enough info for you to write a study of your own if you want. Feel free to ask questions if you need any help; I’m always glad to teach people who want to learn! Alternatively, if you “gotta have it now”, you can get it as “Jackson-ware”. Donate $20 and I’ll email the script out to you. If you donate, be sure to email me and let me know what you donated for so I can send it to you! The Pro MACDDivergence indicator has all the source code I used, including the generalized method to change the number of bars used to identify swing points as a simple input.