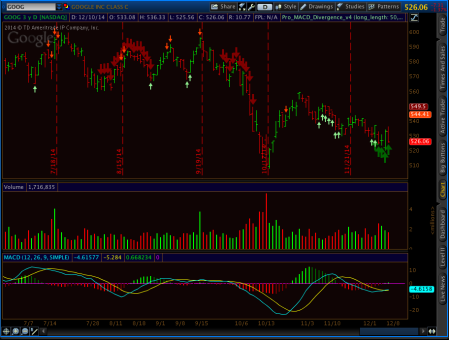

I figured out a way to combine all my divergence indicators into one single study. The new Multi-divergence script uses slopes of linear regression lines just like in the new MACD divergence indicator. This script supersedes all the other divergence scripts. The difference is now it can perform a regression on any one study of your choice from a list of ToS indicators. The indicators currently supported for divergence analysis are:

MACD, RSI, CCI, Momentum, Moneyflow, On Balance Volume, Rate of Change, Stochastic Momentum Index, Ultimate Oscillator, Volume Flow Indicator, Volume Oscillator, Volume Rate of Change, Volume-Weighted MACD, Williams Percent-R, and Woodie’s CCI

(Note that it doesn’t scan all of these for divergence at once. Just the one indicator you select. If you want to have RSI and MACD at the same time for example, you put the script on your chart twice and select the appropriate indicator for each one separately.)

If there is another built-in ToS indicator you want to have available for divergence analysis, let me know and I can add it in future updates. You can use the Multi-divergence indicator on real time charts and in scans of watch lists, and I put in alert logic so it can ping you when a divergence occurs.

This indicator is for blog donors only. You can find it on my google site under Released Thinkscript Studies down in the Donors Only section. If you already donated in the past you can use your password to access it. If you want to become a donor (or throw me some more coin) you can do so by clicking the Donate button:

As always, if you are a DIY’er, feel free to ask questions in the comments and I’ll help answer.